INVESTMENT PHILOSOPHY

Multi-Strategy Approach

We are strong believers in the multi-strategy approach as a means to reduce risk and correlation in our Funds

Exploiting Inefficiencies

Our philosophy is based on systematic inefficiencies in specific segments of the derivatives market

Statistical Edge

Our strategies utilize specific parameters in the marketplace that can provide a statistical edge

Rigorous Risk Management

Rigorous Risk management is a key factor to our success, and this is emphasized in every aspect of our business

Dynamic

Our strategies is dynamic and is highly adaptable to every type of market condition

Systematic

Our trading decision process is purely systematic

We execute all the trades ourselves based on the outcomes of our models.

We execute all the trades ourselves based on the outcomes of our models.

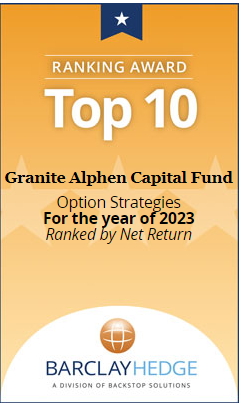

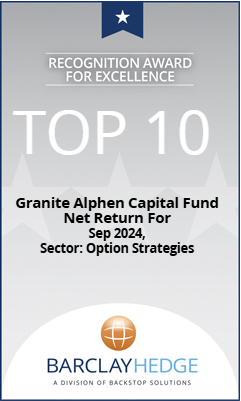

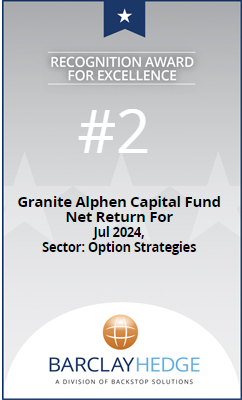

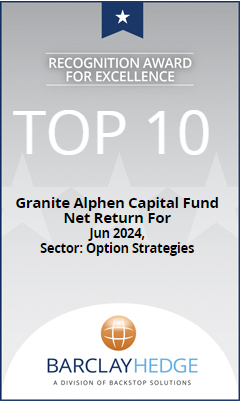

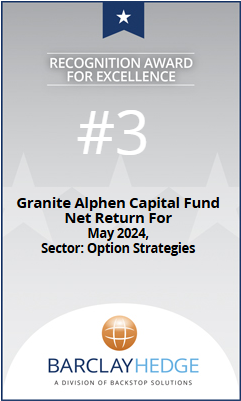

GRANITE HIGHLIGHTS

Granite's alternative group main objective is to provide an absolute high yearly return regardless of prevailing market conditions and volatility.

THE TEAM

Our human capital is our greatest pride. Personal integrity, teamwork and professionalism are the foundations of our team and the key to our success.

FOLLOW OUR PERFORMANCE

SERVICE PROVIDERS

We strive to partner with the best service providers in order to ensure

transparency and quality for our investors.

Granite M.S.A Ltd.

Sea View Building A, 2 HaManofim

St., Herzliya, Israel 4672653